Thank you to everyone that participated in our COVID-19 Environmental Remediation Survey. We started this survey because as we talk to dozens of remediation professionals each week we are getting a sense for how people are adjusting, coping, and sometimes thriving in a pandemic world right now. I particularly wanted to understand more about the impact on small businesses and if the COVID restrictions or just difficulties in traveling and in-person work were having an oversized effect on small businesses. We were very intrigued by the results we found and are happy to share them with you today. Let’s walk through each question and the overall results as well as sliced a few of the questions out by industry and/or company size to give more specific cohort results.

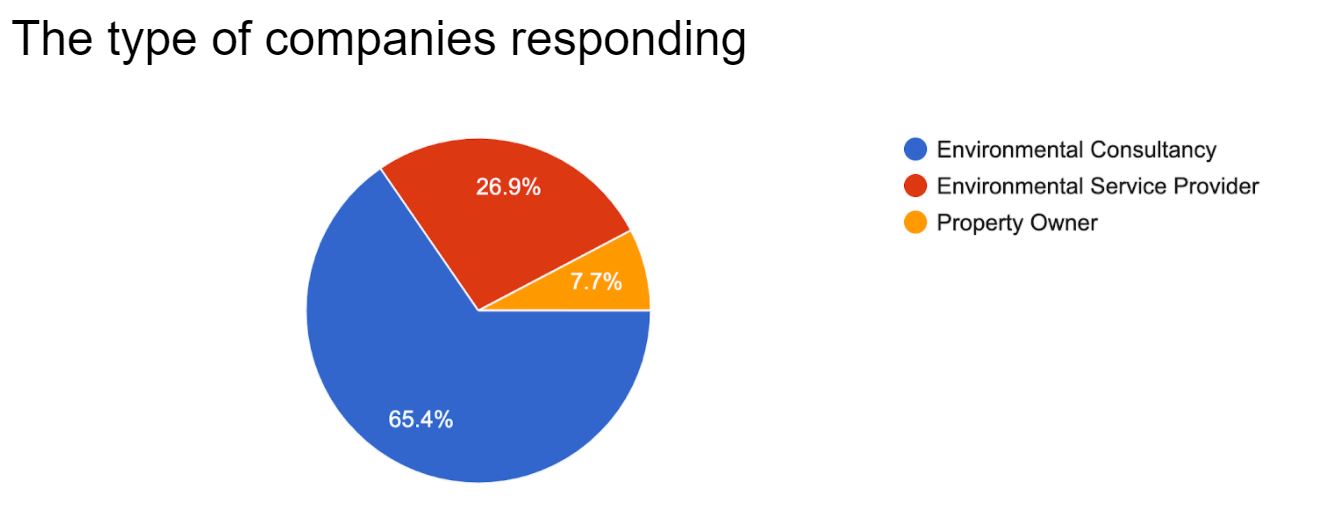

This question gave us context into who we’re speaking with and will be relevant as a way that we slice the data moving forward to see opinions by company type and size. No surprises from us on the breakdown of respondents by category!

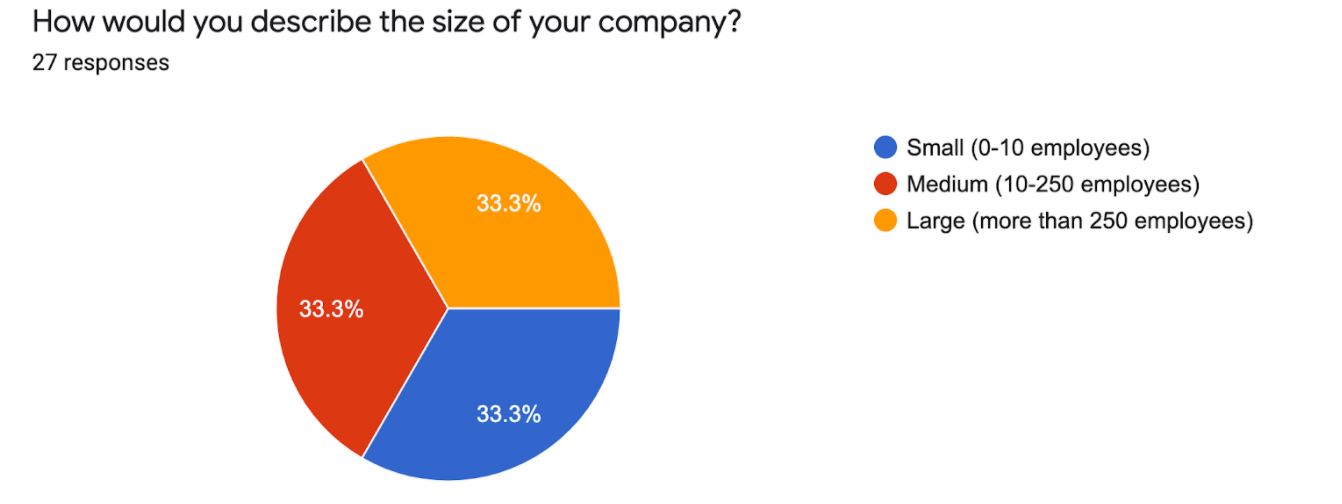

Question 2: How would you describe the size of your company?

Completely even splits are typically surprising and we will use this question to also slice the data across the other responses to see if there are trends in how COVID is affecting different size organizations.

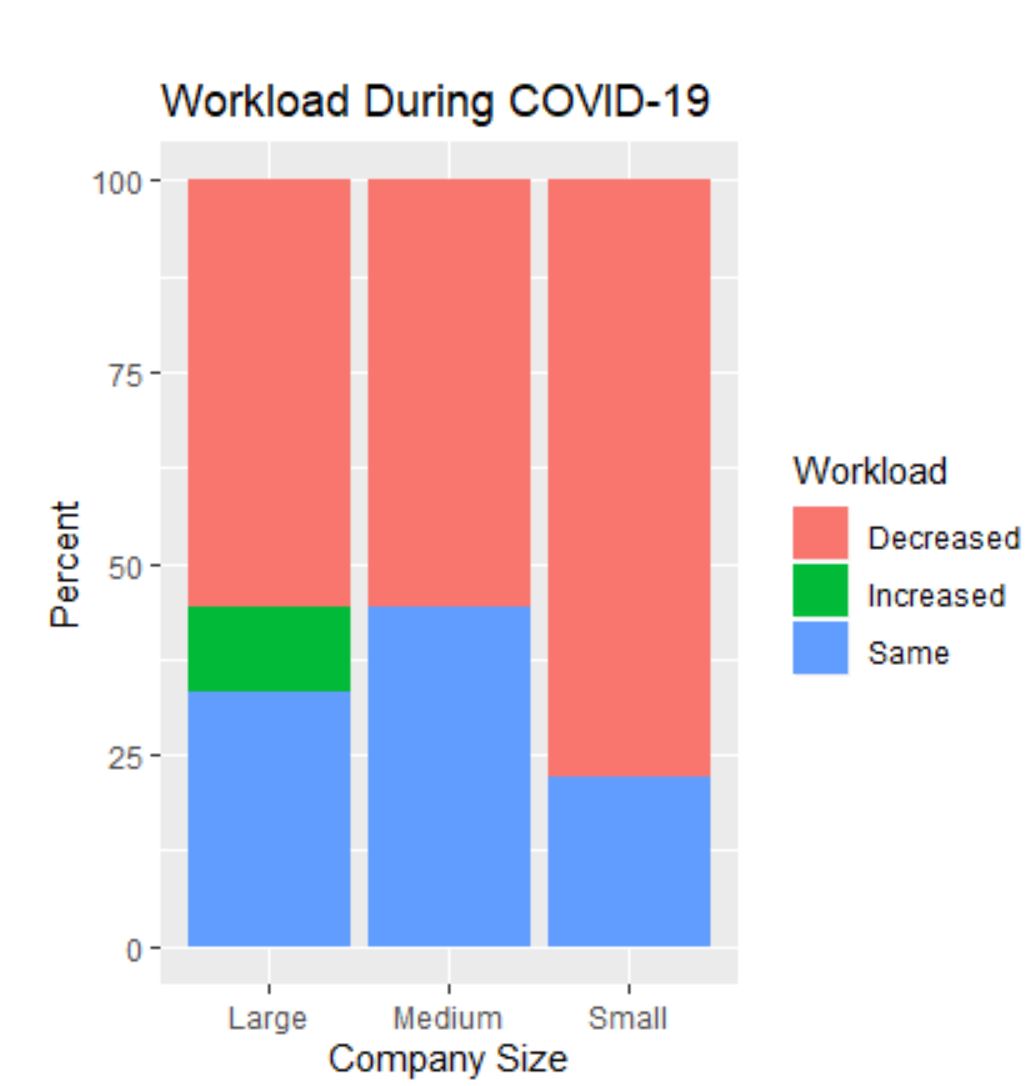

Question 3: How has your level of field work changed since COVID-19?

Also no surprises here that the majority of respondents have seen a decrease in work. Slicing the data by size and company type reveals a few other findings:

- Property Owners: all responded that work load has not changed for them

- Environmental Consultancies: overwhelmingly stated that work has decreased, but large environmental consultancies also had the only responses for increased work since COVID-19.

- Service Providers (Lab, drillers, direct sensing, etc): across all size companies noted decreases or no change.

- Small companies: 78% saw a decrease and 22% with no change

- Medium companies: 55% saw a decrease and 45% no change

- Large companies: 55% saw a decrease, 33% no change and 11% increased

Our takeaways from these breakouts were that small companies have been the hardest hit with decreases in work, with larger companies competing hard to maintain work levels, and even increase in a few cases.

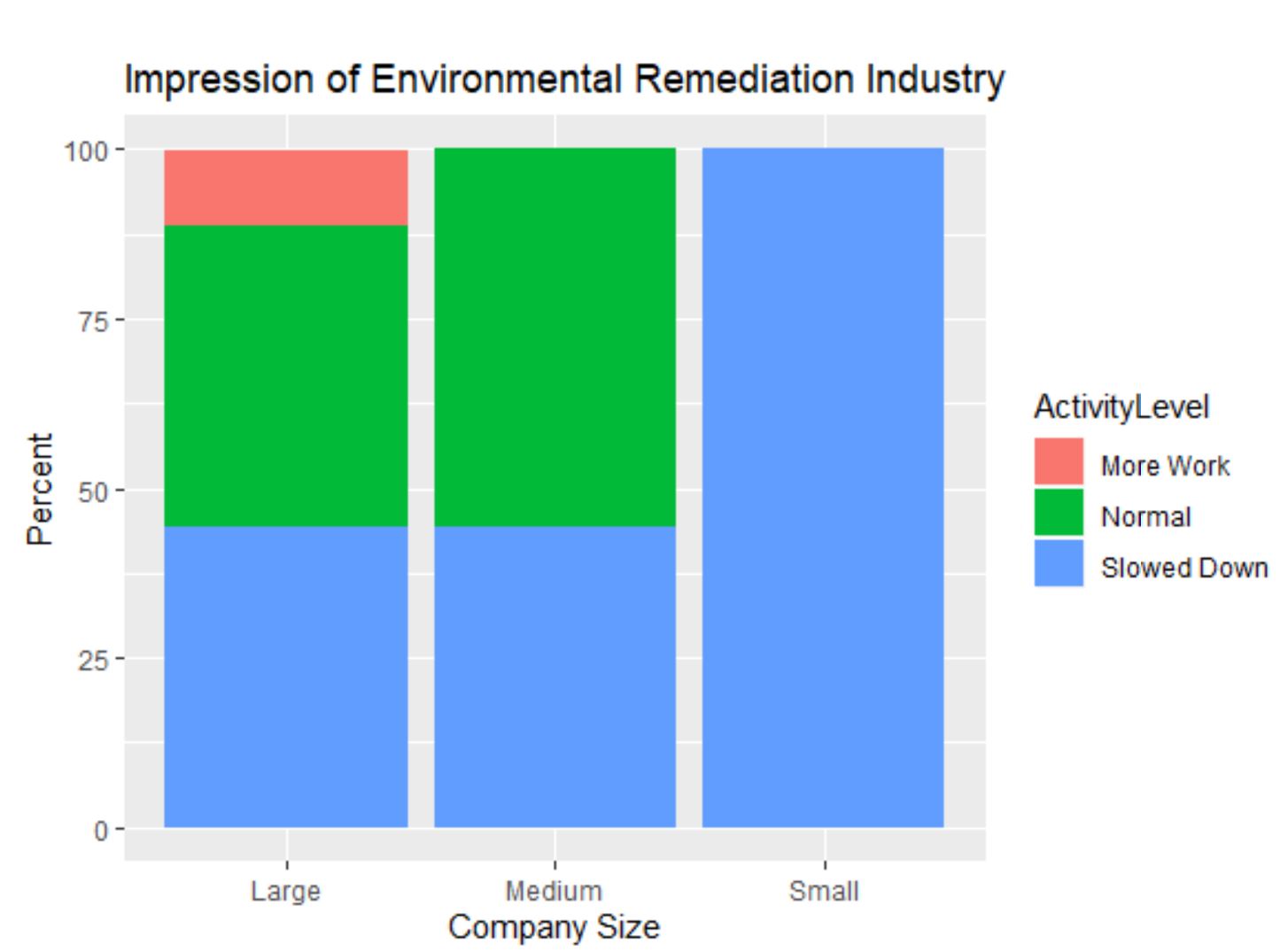

Question 4: What is your impression of the environmental remediation industry’s activity right now?

Completely reflective of the last question, and likely affected by it, most everyone sees the industry as slowing down with the following breakouts:

- Property owners were split on the industry remaining the same and more work

- Environmental consultancies reflect the last question with 65% seeing a slow and 45% remaining the same

- Small and Medium size ESPs all believe the industry has slowed down while large ESPs see it as unchanged.

- 100% of small companies said the industry had slowed

- Medium companies had a majority position of it remaining the same and 44% saying it has slowed

- Large companies were more split with 33% decrease, 33% same and 11% growing

Like the other question, our takeaway was that the small businesses are the most affected while both medium and large companies had a majority perspective of unchanged or growing.

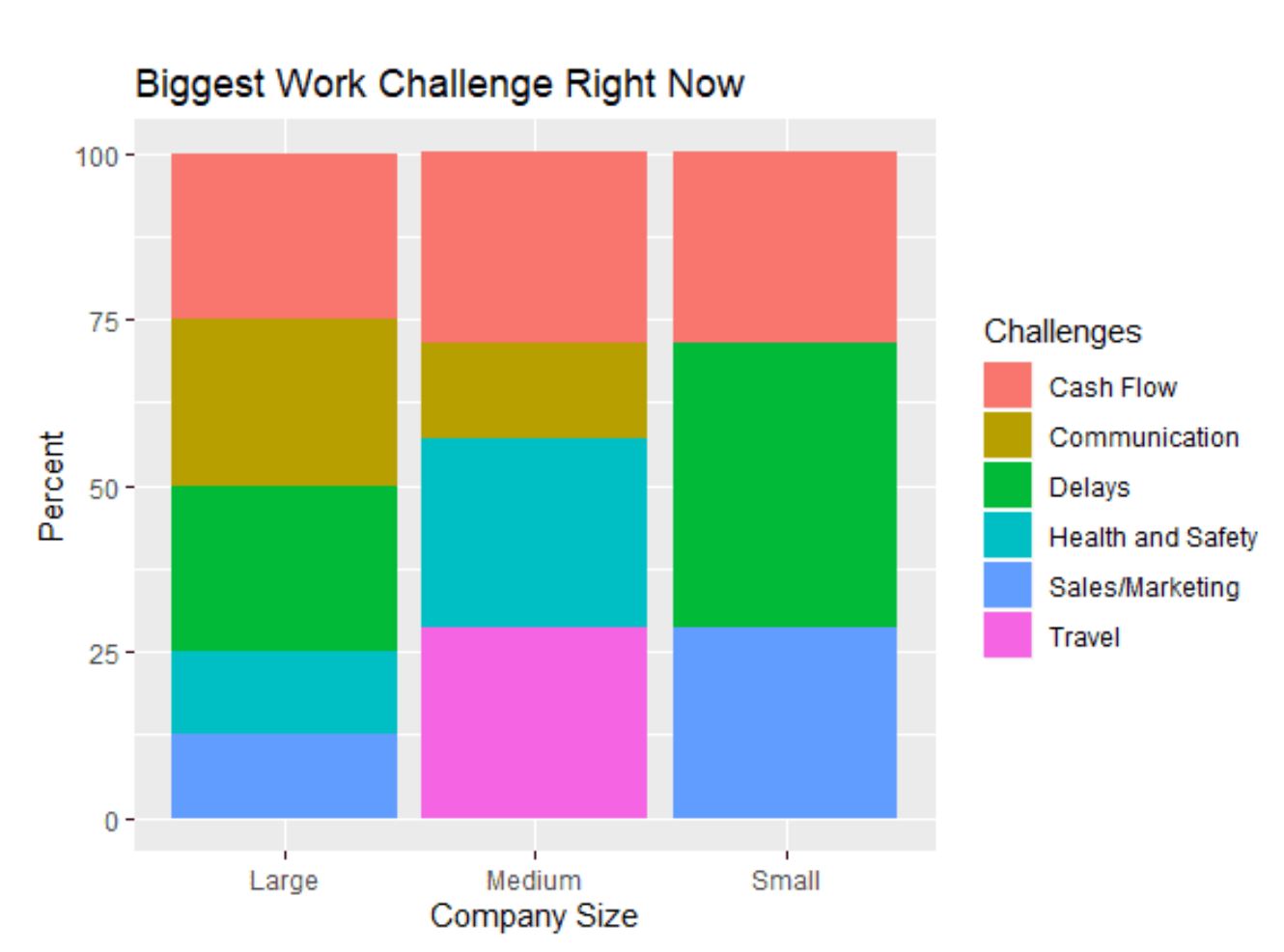

Question 5: What is your single biggest work related challenge right now?

For this question we asked you to write out responses and then we categorized them. The greatest category dealt with the financial effects of COVID with delayed projects leading to cash flow issues and potential/actual layoffs and the need for more sales and marketing support to make up for the lost revenue. The second overarching category dealt with safety and regulations including travel restrictions, PPE, and the effects it’s having on getting results back. Taking a look at these answers by company type and size we saw the following:

- Environmental Consultancies saw a mix of these in almost equal portions with small ones completely focused on the financial aspects, medium more concerned with health and new communication styles and large with a majority focused on layoffs and getting new business.

- Service providers across all sizes were 70% concerned with financial aspects with only the medium and large companies showing concern in the safety and new work environment categories.

- Property owners were concerned only with new safety concerns and work environment.

- Small businesses were 50% focused on delayed projects with the rest of the answers focused on financial concerns as well.

- Medium businesses were only 25% concerned with financial matters and more focused on travel and safety concerns.

- Large businesses were 37% concerned with financial matters and the rest focused on health and lab issues during the pandemic.

We were surprised to see 75% of large consultancies focused on potential layoffs and needing to get more sales since the other categories had shown these as the least affected companies in the group.

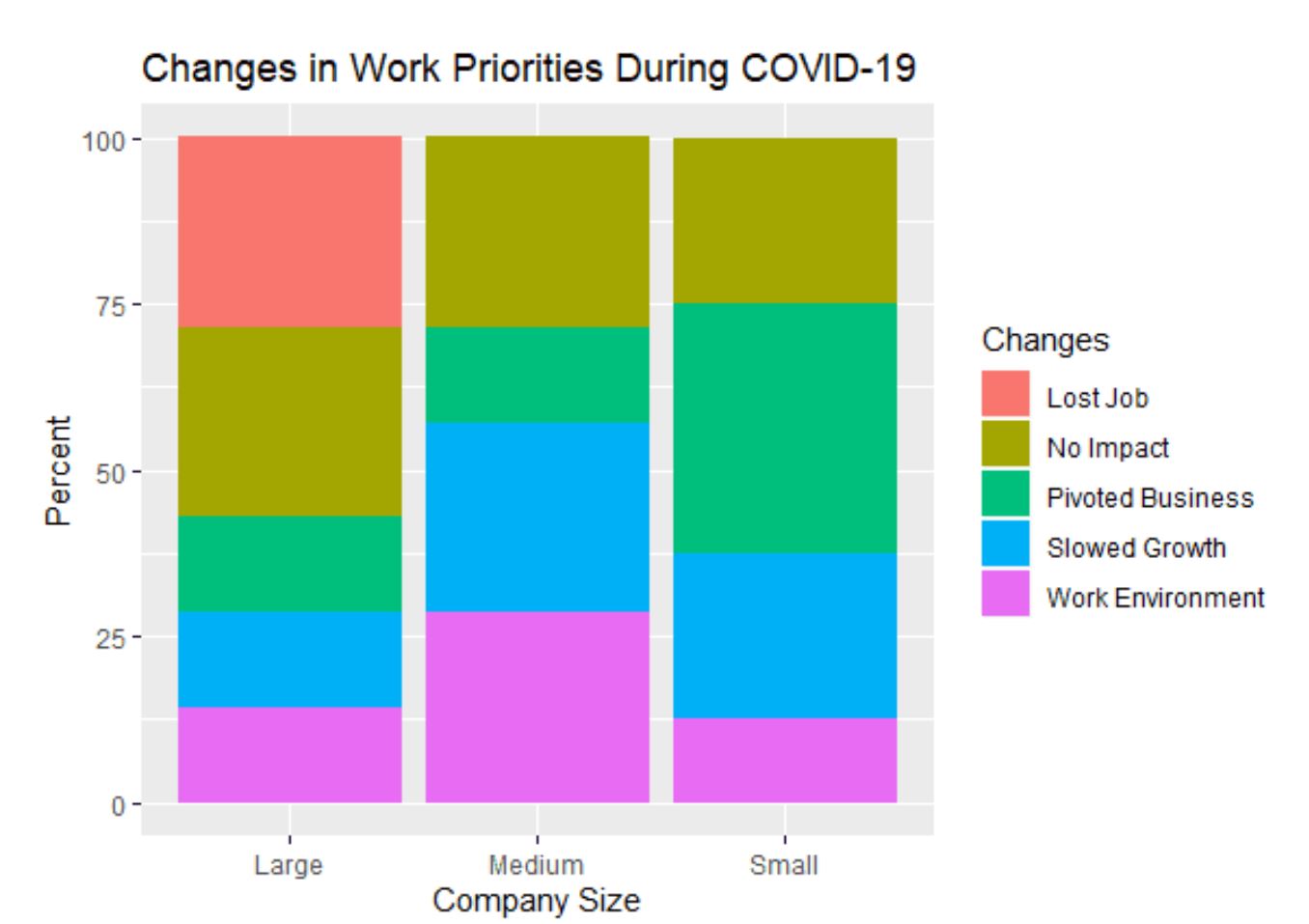

Question 6: How has COVID-19 changed your work related priorities?

With this question we surprisingly found that COVID has not affected the priorities of the largest group of respondents. Beyond that, the answers were split amongst changing business models and changing the way the work is actually done both virtually and on site. Below you can see the breakdowns by group:

- Large Consultancies did see layoffs and all sizes saw slowed growth.

- Property owners saw the least impact overall.

- Small ESPs had the highest proportion of needing to pivot their business with small companies broadly reporting the need to pivot overall.

- Medium companies had the most diverse response and the largest concern for work environment changes.

Overall it seems that priority changes have been the same across all company types and sizes with everyone adjusting to the new financial and physical impacts of the pandemic.

Conclusions

Based on these insights you can see that the small businesses are taking the biggest hits at the moment but all sizes and company types are struggling financially with the impacts from COVID. Our interpretation is that the environmental remediation industry is not contracted due to health and safety concerns or lockdown orders, but from overall economic conditions in the larger state and national economy. During the time when remediation projects are not being addressed, there is a growing pent up demand for environmental services. Once the greater economic issues are addressed, that pent up demand should result in a resurgence of work for the re-emerging industry in 2021.

Jason Dalton

President, CEO

Daybreak